5 Purchases You’ll Wish You Never Made

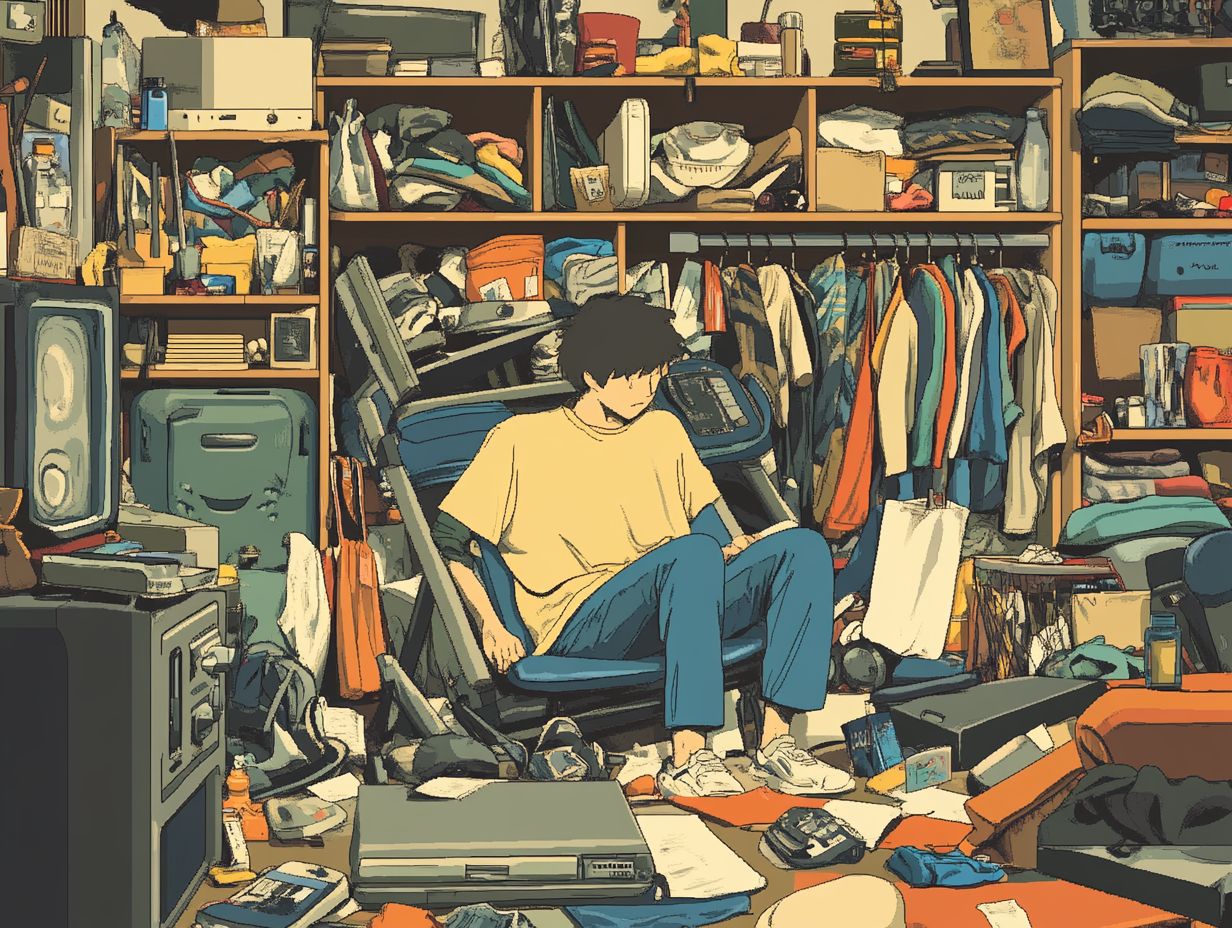

You know that sinking feeling you get right after making a purchase, wondering if you made the right choice? That’s what we call **buyer’s remorse**, and it can hit anyone, especially after those **impulse buys**, **big ticket items**, or those oh-so-tempting **subscription services**.

This article dives into the **psychology** behind your spending habits, shares some handy tips to help you avoid unnecessary purchases, and guides you through the tricky waters of **sales** and those **gimmicky products** that seem to pop up everywhere.

By understanding these common pitfalls, you’ll be better equipped to make **thoughtful, informed decisions** that keep your wallet feeling pretty happy.

Understanding Buyer’s Remorse

Understanding buyer’s remorse is key for anyone trying to navigate the often chaotic world of shopping and consumer goods. You might find yourself regretting a purchase, whether it was an impulsive buy, a trendy item you got emotionally attached to, or just feeling unsatisfied with what you chose.

This feeling often comes from psychological factors like the urge for instant gratification, the fear of missing out, or even the pressures of society that can cloud your judgment. When emotions take the wheel, it’s easy to slip into emotional spending, which can lead to financial blunders that throw your budget off track.

Recognizing these patterns is super important because it helps you come up with strategies for managing that regret. For instance, you could implement a cooling-off period before making big purchases or stick to a budget that aligns with your financial goals.

By understanding how emotions influence your buying choices, you can improve your decision-making process and build healthier financial habits.

Impulse Buys

Impulse buys can really lead to buyer’s remorse, and they often reflect the emotional triggers that influence your spending habits and consumer behavior.

Those spontaneous purchases—whether it’s that fancy gadget, trendy clothing, or a luxury item—are usually fueled by marketing tactics, social media buzz, and a bit of peer pressure.

If you take the time to understand why you sometimes give in to impulse buying, it can help you develop healthier shopping habits and improve your financial literacy.

By recognizing your spending triggers and weighing the cost versus the benefits of potential purchases, you can steer clear of the emotional spending trap and make more informed decisions.

Why We Make Them and How to Avoid Them

Understanding why you make impulse buys is crucial for developing strategies to avoid them and manage buyer’s remorse effectively. Impulse purchases often come from psychological triggers, like emotional attachments, fleeting desires, or those clever marketing tactics that create a false sense of urgency.

You might find yourself caught up in the moment, swayed by flashy ads or the influence of friends, triggering an immediate emotional response. This can easily cloud your logical thinking, leading to that familiar feeling of regret after the purchase.

By grasping these dynamics, you can align your spending habits more closely with your personal financial goals. Creating a structured financial plan is key—it should include setting clear budgets and focusing on differentiating between genuine needs and simple wants.

Using practical tools like expense tracking apps and budgeting worksheets can make this process smoother. They help you keep a clearer perspective on your finances and develop a more disciplined approach to spending.

Big Ticket Items

When you’re dealing with big-ticket items, making informed decisions is key to ensuring your investment is worth it and doesn’t lead to any financial blunders later on.

Luxury items, electronics, or travel experiences tend to come with hefty price tags, so you’ll want to do a thorough cost analysis.

Before you dive into a major purchase, it’s important to look beyond just the upfront cost. Think about hidden costs, the product’s lifespan, and the long-term impact of your choice.

Taking the time to evaluate everything carefully can help you steer clear of buyer’s remorse and make sure you’re investing in something that fits your financial goals.

Factors to Consider Before Making a Major Purchase

Before you make a big purchase, it’s crucial to think about various factors that could impact your financial health and overall satisfaction. You’ll want to weigh the cost versus the benefits of those big-ticket items, whether they’re electronics, luxury goods, or travel experiences.

Having a clear picture of your financial situation and long-term goals will help you make the best choice. Plus, knowing your consumer rights and protections can give the power to you to make more informed decisions and avoid those sneaky pitfalls that lead to buyer’s remorse.

Taking the time to assess your options can really enhance your decision-making process and reduce the chance of feeling regret later on.

On top of that, diving into product reviews from fellow consumers can give you valuable insights into not just how well the item performs, but also its reliability. User experiences are key, as they highlight real-world applications and potential issues that might not be obvious from the manufacturer’s description.

Also, checking out warranty options and understanding guarantees can save you money and stress down the road, ensuring you’re covered in case something goes wrong or you’re just not satisfied.

By weaving these important evaluations into your financial planning and budgeting strategies, you can give the power to yourself to make choices that align with your goals and ensure a positive outcome from those major purchases.

Subscription Services

Subscription services are super popular these days, giving you convenience and access to all sorts of consumer goodies. But watch out—they can also come with hidden costs and financial slip-ups that can mess with your budget.

It’s easy to get caught up in the cycle of emotional spending, signing up for the latest gym memberships, streaming services, or those monthly subscription boxes without really thinking about their long-term value.

Understanding the ins and outs of subscription services helps you make smarter choices and dodge those unnecessary expenses that lead to buyer’s remorse. By taking a good look at your subscription habits and doing a thorough cost analysis, you can make sure you’re not blowing your budget on services that barely see the light of day.

Hidden Costs and Alternatives

When you’re looking into subscription services, it’s super important to keep an eye out for those sneaky hidden costs that can pile up and turn into unnecessary expenses over time. A lot of subscribers miss things like cancellation fees, promotional rates that run out, or charges for add-ons, and those can really mess with your budget.

Considering alternatives to popular subscription services, like thrift shopping or using free resources, can give you more bang for your buck and help you dodge that dreaded buyer’s remorse. By weaving some smart budgeting and financial planning into your shopping habits, you can navigate the subscription world like a pro.

On top of those hidden fees, you also want to think about the total cost of ownership compared to the benefits these services offer. For example, if a monthly streaming subscription ends up costing more than renting a few movies here and there, you might actually save money by sticking with the rentals.

Many people also don’t take a close look at how often they really use their subscriptions. Signing up for platforms they barely engage with can lead to wasting money. By regularly checking in on your subscriptions and figuring out what really adds value to your life, you can align your spending with your priorities. This way, you’ll boost your financial well-being and cut back on unnecessary debt.

Sale and Clearance Items

Sale and clearance items can be super tempting, but it’s crucial for you to figure out if you’re really scoring a good deal or just throwing your money at overhyped products.

Sure, those discounts look great, but if you don’t take the time to analyze the costs and evaluate the product features, you might end up with a case of buyer’s remorse pretty quickly after your purchase.

Understanding shopping trends and consumer behavior can really help you tell the difference between genuine bargains and impulsive buys that just leave you feeling let down.

By keeping a critical eye on those clearance sales, you can confidently navigate your shopping experience and dodge unnecessary expenses.

How to Determine if It’s a Good Deal or a Waste of Money

Determining if that sale item is a real steal or just a money pit requires some careful thought and cost analysis on your part. By checking out product features, comparing prices at different retailers, and keeping an eye out for any hidden costs, you can make smarter choices that fit your financial goals.

Plus, taking advantage of buyer protection policies can help protect your investments and give you some peace of mind when snagging those discounted items. This proactive shopping approach can help you navigate clearance sales without falling into the trap of buyer’s remorse.

Before you hit that buy button, it’s wise to assess the actual value of the offer. One effective strategy is to create a side-by-side comparison of similar products, noting things like durability, warranty, and customer feedback.

This way, you can spot significant differences in quality and get a clearer idea of the overall value. Familiarizing yourself with buyer protection laws also helps you understand your rights, making sure you can seek redress if something goes wrong, like misrepresentation or faulty goods.

In the end, adopting these strategies leads to a more financially savvy shopping experience.

Gimmicky Products

Gimmicky products often come with flashy promises of quick fixes or unique experiences, but they often don’t deliver and can leave you feeling that dreaded buyer’s remorse.

These overhyped items might catch your eye with clever marketing and emotional hooks, but it’s essential to recognize their true value to avoid making costly mistakes.

Being aware as a consumer is key to spotting these gimmicks and making smart choices that focus on long-term satisfaction rather than just a quick thrill.

By taking a closer look at marketing claims and evaluating product features, you can shield yourself from unnecessary spending.

Identifying and Avoiding Products That Don’t Live Up to Their Claims

Identifying and steering clear of products that don’t live up to their claims is key to keeping your finances in check and feeling good about your purchases. It’s all too easy to end up disappointed after splurging on gimmicky products that just don’t deliver, leading to buyer’s remorse and those annoying extra expenses.

To protect yourself, make it a habit to research product reviews, check out user experiences, and know your consumer rights before you hit that buy button. When you’re armed with knowledge, you can make smart choices that prioritize value over all that marketing fluff.

Engaging in product comparisons can really boost your shopping confidence. By looking at similar products side by side, you can quickly see which options actually offer the best features and value for what you need.

It’s also a good idea to tap into multiple sources, including expert opinions and consumer feedback, to get a well-rounded view. And don’t forget, exercising your consumer rights can give you the power to seek refunds or exchanges if a product doesn’t meet your expectations. This proactive approach not only protects your wallet but also makes for a much more satisfying shopping experience overall.